Now, I’m at pains to point out — the DAO is not a “Venture fund”. It cannot own equity in a company (though theoretically it could own tokens in other DAOs). Rather, “Contractors” can make a proposal to the DAO, which includes a value proposition, and the DAO can choose whether to fund it.

A value proposition may or may not be financial. It may, as in the Slock.it proposal, indicate that the DAO will receive some revenue stream as a result of the proposal it funds. Equally we can imagine proposals which simply increase the utility of the DAO without directly providing a return on investment.

Sounds pretty cool, huh? I think so, and consequently I’ve put my Ether where my mouth is — which brings me to the core of this article. Let’s not fuck it up, eh?

The Problem

Let’s get allegorical for a moment.

In 1975, three researchers named Worchel, Lee, & Adewole demonstrated that, given two identical jars, one containing ten cookies and another containing two cookies, test participants valued the jar with fewer cookies more highly.

As the experiment continued, they wanted to find out what would happen to the perception of value of the cookies if they were suddenly to become more or less abundant.

Groups were given jars with either two or ten cookies. Those with ten cookies would have someone come and take eight away from them. Those who started with only two would have an additional eight cookies added to their jars.

The research showed that the groups who were left with only two cookies valued them highly, whereas the groups who suddenly had an abundance of cookies valued them the least. They actually valued them even less than groups who had ten to begin with.

In other words, the study showed that things decrease in perceived value when they suddenly become abundant.

That sudden abundance is what we have here.

For many of us, the Ether which created the DAO is wealth acquired very quickly. Not by hard work and years of saving, but by the rapid appreciation of Ether, and in many cases Bitcoin before that. As a consequence, we irrationally undervalue these assets and underestimate the risk of investment.

So, how can we ensure, as I previously mentioned, that we don’t fuck this up? That we don’t fund lousy projects which generate zero ROI and drag down the reputation of Ethereum, The DAO, and all the great Curators who have associated their names with it?

The bad news is, we can’t. Most venture funds generate negligible return. There is a very good chance the DAO will generate zero return and we may very well all lose our money.

That said, we can at least try to avoid fucking it up, by not wantonly throwing our cookies around.

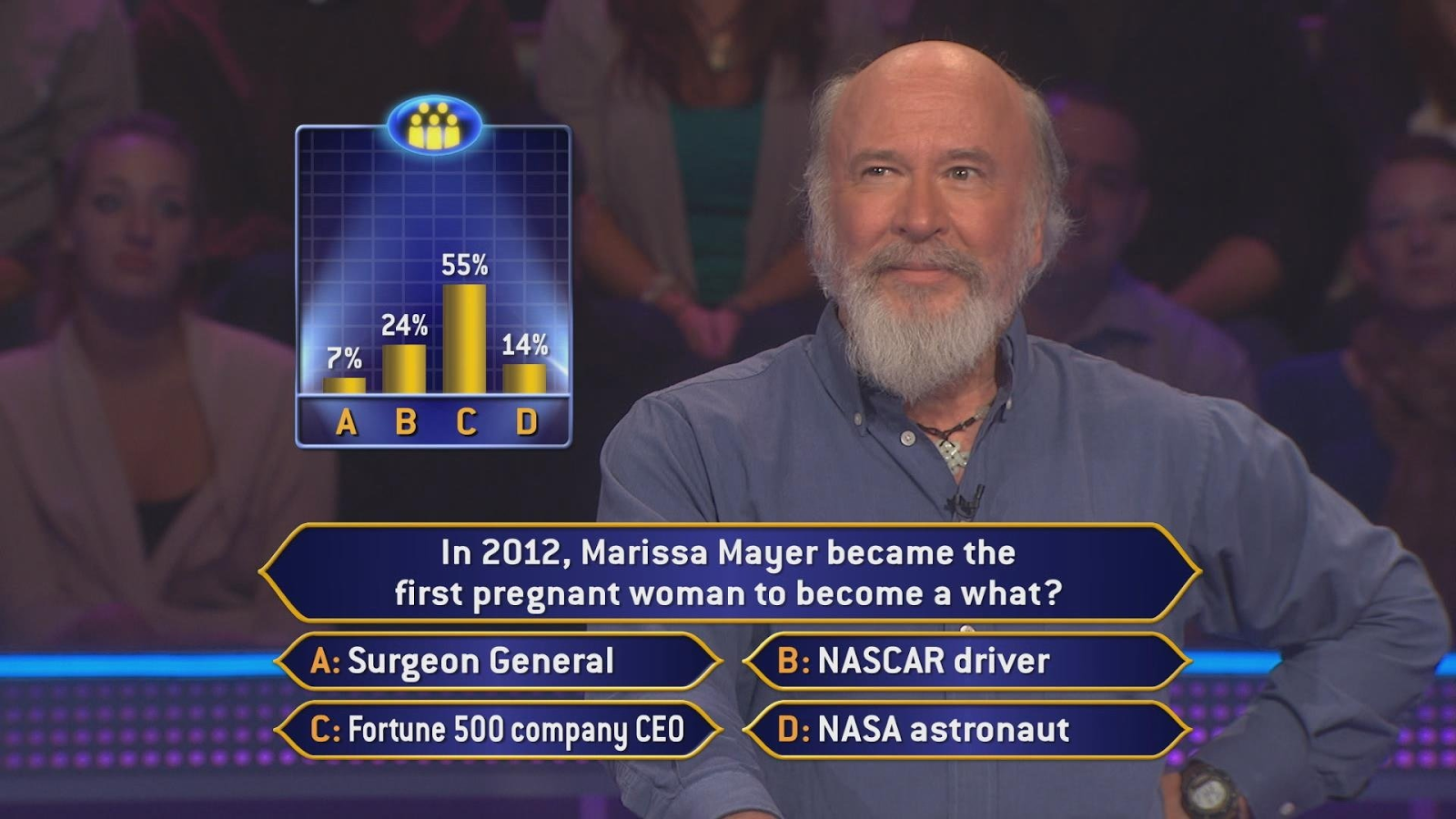

Like Augur (and Colony), the DAO’s ability to make effective decisions is predicated upon “the Wisdom of Crowds”. It purports that, given a sufficiently diverse group of people able to make independent decisions, they will more reliably make smart decisions than even the smartest individual among them.

The key characteristics for a crowd to be collectively wise are:

- Independence

- Diversity of opinion

- Decentralisation

The best decisions are a product of disagreement and critical enquiry. However, too much communication actually makes the group as a whole less intelligent, as a panoply of cognitive biases come into play.

Collective intelligence works because, given the ability to aggregate diverse perspectives, the noise (people who are wrong) cancels each other out and the signal (people who are right) shines through. A good example of this is the “Ask the Audience” lifeline on the game-show “Who Wants To Be A Millionaire”.

However, crowds can also make very bad decisions. It is usually when members of groups pay too much attention to the opinions of others and find themselves emulating one another rather than acting independently on their own private judgement.

For us this is a problem. We as a community, and as creators of the DAO, do not well meet the above enumerated criteria for effective collective intelligence: we are overwhelmingly white, male, middle class, western nerds.

We all hang out in the same places online; we all read the same articles; we all know the same people — we simply cannot help but be homogeneous, and that will hurt our ability to make good decisions. So what can we do to fix it?

Approach

We need structure and process to guide us. To do that well, we should look to the people with analogous experience. There is much we can learn from Venture Capital. While they may not be perfect, they have established best practices. It is better to stand on the shoulders of giants than to start anew just because there’s a blockchain involved.

So, although the DAO is not a venture fund, it has many of the same needs in evaluating proposals. In that evaluation, VCs basically fall into one of two camps:

Spray and Pray

The thinking is that there is just too much volatility in investing in early stage projects. It’s too hard to pick winners as there are too many unknowns, so your best approach is to diversify as much as possible and make very quick decisions.

An example of this are accelerators like YCombinator. While with accelerators, companies do get more than cash (mentoring, connections, validation, free stuff). The basic model is to invest a little ~$20k — ~$120k in a lot of companies. Most will fail, but hopefully a few of those will yield exponential returns.

YC has had excellent success, yielding some of the most important companies in the world today like Airbnb, Dropbox, and Stripe to name but three. YC are, however, anomalous. Even the most well known accelerators not called YCombinator cannot claim anything remotely approaching this level of success.

I think that’s because to a greater extent than any other, YC temper their Spray and Pray with…

Selectivity

The thinking here is exactly opposite. You can come up with a good plan and execute on this deliberately. Success isn’t by definition unknowable. It is knowable. You just need to find the right people to do it and invest in them. An example of this approach is Peter Thiel’s fund.

Peter Thiel does deep due diligence on particular points that dictate the success of a startup.

In his book “Zero to One”, Thiel outlines 7 key questions to evaluate startups:

The Engineering Question — Can you create breakthrough technology instead of incremental improvements?

The Timing Question — Is now the right time to start your particular business?

The Monopoly Question — Are you starting with a big share of a small market?

The People Question — Do you have the right team?

The Distribution Question — Do you have a way to not just create but deliver your product? How credible is this?

The Durability Question — Will your market position be defensible 10 and 20 years into the future?

The Secret Question — Have you identified a unique opportunity that others don’t see?

These questions provide a framework for how to evaluate an investment into a technology company. They are equally effective in evaluating a DAO proposal.

Due Diligence

But satisfying Thiel’s criteria is just the appetizer. Assuming you like the sound of the Contractor’s menu, the main course is diving deep into due diligence.

Due diligence is a rigorous process that determines whether or not the venture capital fund or other investor will invest in your company. The process involves asking and answering a series of questions to evaluate the business and legal aspects of the opportunity.

Prospective Contractors should provide, at a minimum:

Transparency: Clear comparison of the expected benefits to both the Contractor and the DAO. Stakeholders: The story of the founders and their involvement in the Proposal. Where relevant, it should detail any other beneficiaries or stakeholders. Think: cap table.

Data: The metrics that matter for the Contractor’s business—growth / traction, engagement, distribution, partnerships, etc. The data should demonstrate why the proposal is a good value proposition for the DAO.

Legal / contracts: Legal entity details, previous or ongoing disputes, IP — does the Contractor own all of their IP, or is the proposal contingent upon closed source IP created by a third party?

Dependencies: Is the project dependent upon any third party for its delivery? If so, what safeguards or contingencies are in place to ensure performance of proposal in the event of supply chain failure?

Financials: Direct proposed ROI and means of delivery. Good pro-forma financials which clearly chart burndown vs requested funding monthly. How Ether volatility will be managed. No fairytale financial “projections”

Competitor analysis: Who else is in this space? Why you?

References: from trusted/noteworthy individuals

Investment Thesis

Venture Capital funds never invest randomly. They always have some rationale by which they court, screen, and select investments. We need to establish some kind of investment thesis for the DAO. What kinds of things will the DAO will invest in?

I suggest that there are four pillars of the DAO investment thesis: focus, trust, philosophy, and size.

Focus

In their recent video AMA, Christoph Jentzsch stated his opinion that the DAO should focus on IoT and the Collaborative Economy. I don’t know if it needs to be so restrictive, but I do agree that we should avoid funding trivialities. We have an opportunity to fund truly groundbreaking technology projects, let’s make that the goal.

I would possibly suggest that some small portion of the funds could be earmarked for proposals which pass both the Thiel Test and ‘due diligence’, but do not provide a direct return for the DAO.

Rather, they either increase the utility of either the Ethereum network or the DAO itself. Examples might include things like Swarm and Whisper which both have the potential to be massively useful to developers of decentralised applications, and are currently chronically underfunded.

Trust

As it stands, the DAO requires trust. The DAO must trust that ‘Contractors’ will perform the services they have been contracted to undertake. There is some talk of drip feeding funding in some cases, but this might not always be possible.

We need to take a view on how much trust we are willing to tolerate, as trust and personal reputation of the Contractor is practically all the DAO has to go on. As the DAO does not have any legal personality, according to my understanding, it’s only recourse against a Contractor who does not meet their obligations would be for individuals within the DAO to mount a class action lawsuit — a non-trivial undertaking. Unless the figures in question are extremely substantial, this will practically never happen.

How then can the DAO mitigate this vulnerability? Intuitively, it seems that mandating payment derived at point of transaction via smart contract would be helpful. However, it comes at the cost of dramatically reducing the size of the addressable market for any Proposal. Fiat payments may in many cases need to be possible, but we’ll need to have clear reporting mechanisms to ensure payments made to the DAO may be reconciled with revenue transacted.

Philosophy

The DAO is not a venture capital fund. VCs are looking for an “exit” in 5–10 years. The DAO can’t really get “exits” as it can’t own equity (though it could own other DAOs).

The DAO should not look primarily at high risk, long term, investments which provide a more or less binary outcome like VCs do. The DAO should be operated more like a company: look for regular, meaningful revenue, profit, and value growth; not the big kill. Consequently it should also not tolerate the same level of risk in the proposals it accepts.

The value proposition made by a prospective Contractor needs to be clear, strong, direct, and secure.

Size

If it were a Venture Fund (which of course it isn’t), a $120M fund would probably be focussed on Seed and Series A rounds. Ticket sizes around $300K to around $5M. A venture fund would look to do a minimum size of cheque because they have limited time and resources to spend examining and processing deals, and they need to get their capital deployed. The DAO has massively more bandwidth to assess deals than any investment fund ever has, and we also have an automated system for deploying the capital. Therefore, we can afford to look at a broader range of ticket sizes.

In venture capital, rounds of funding increase in size as validation of product market fit and competence of the startup is proven. There are no projects in Ethereum which are in the position to raise a series A. They are all unproven seed round stage projects which have not achieved anything close to product market fit.

Therefore, despite the fact that it has seemingly become de rigeur for even the most pedestrian Ethereum based token sale to raise millions of dollars, it doesn’t mean that millions of dollars should be thrown at anything proposed to the DAO without a damn good reason for why it needs that much money before validating product market fit.

I would propose that there are broadly five categories of proposal

Research Project Grants: $5k — $30k

Small, speculative grants believed to have potential to substantially move the technology forward.

Rather like WanXiang’s DevGrants Program.

Perhaps these could be administered quarterly to a max of ~$50k quarter?

No expectation of financial return, but the grant must produce something useful and open source.

Fundamental Technology Grants: $50k — $150k

Larger grants for projects which have either built a successful proof of concept from a Research Project Grant or which have done so independently, have proven teams and have the potential to provide significant utility to either the DAO or Ethereum in general.

ROI not mandatory. The idea would be that in the case of improving The DAO, it’s just a straightforward investment in making it more useful. For Ethereum network projects, increasing the utility of the network may have the indirect consequence of increasing Ether price.

Very Early Stage Projects: $50k — $150k

Commercial projects which intend to provide a return for the DAO but which do not have a track record.

Must have at least a prototype and rate highly on the Thiel test (above). Ideas are worthless. Execution, bitches.

Financing is administered monthly in advance, subject to satisfactory delivery of milestones.

There should be a clear and direct ROI, but perhaps there could also be leniency at very early stages.

Early Stage Projects: $250k — $1m

Projects which have strong indications of product market fit. A solid go to market plan and a clear, compelling value proposition. Medium risk.

Financing is administered monthly in advance, subject to satisfactory delivery of milestones.

There must be clear and direct ROI.

Later Stage Projects: $500k — $3m

For the most advanced and accomplished projects, proven teams and lower risk.

Financing administered in reasonable tranches.

There must be clear and direct ROI.

Conclusion

There is much to consider when deciding whether to fund a proposal to the DAO. A simple binary decision after reading a proposal document is not a sufficiently robust approach to deploying $130m.

Not only do we need to understand the context in which we are assessing proposals, we also need a way to make those decisions well by recognising our cognitive limitations. The problem we face is not technological as such, but rather, social. Our ability to make collectively wise decisions is impaired by our circumstances.

I propose the development of an application through which Proposals to the DAO may be made by prospective Contractors and independently assessed by DAO Token holders.

By breaking the application into discrete, individually assessed components, we can reframe the question of funding away from broad generalities easily corruptible by cognitive biases, and towards specific responses to specific questions, where the relative merits of individual proposals may be more objectively assessed.

After completing the assessment of a Proposal, the application would generate an overall score. The score would determine whether or not, rationally, we should vote to approve, or decline, and allow that voting to happen in app.

If we choose to ignore our own judgement and act irrationally, so be it.